HOW HEALTHY IS YOUR PORTFOLIO?

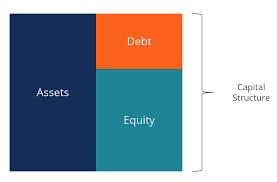

A COMBINATION OF EQUITY, DEBT AND INSURANCE MAKES FOR A GOOD PORTFOLIO FOR FIRST- TIME INVESTORS ‘In mutual fund investments, the most important thing is to choose the right portfolio at the right time’ Which all assets should a first-time investor have in his portfolio? This is one of the most asked questions for best financial planners and advisors in India. According to them, for a basic plan for a first-time investor, exposure to equity and debt products and also insurance plans are the must-haves, provided these assets match with the person’s risk profile. For starters, gold may also be included. DEBT Usually fixed income assets like debt mutual funds, bonds and fixed deposits carry relatively lower risks than equities. So an investor should invest some amount of his total corpus into debt assets. EQUITY Equities create wealth in the long term, and they are strictly not for meeting ... Read More